Over the past few years, quantum computing has evolved from a niche research topic into a major investing trend. Certainly, this trend is attracting global attention. Further, as we move into 2026, quantum computing investing is no longer only for tech insiders — it’s becoming a real opportunity for forward-looking investors.

In this blog, we will break down the concept of investing in quantum computing as

- Learn How to Invest in Quantum Computing— Identifying emerging companies and ETFs to understand the technologies driving this revolution. Whether you are a new investor or a tech enthusiast, you will gain actionable insights into this cutting-edge field.

- Discover Where the Smart Money Is Flowing—Wondering where top investors are placing their bets? This section will explore where the smart money is flowing in the quantum computing sector. Subsequently, this inlvolves from major players like IBM and IonQ to fast-growing startups, thereby redefining the future of quantum computing.

- Understand the Realistic ROI Scenarios—Quantum computing is a long-term play. This part will analyze realistic ROI projections for 2026 and beyond. Consequently, this will help to understand potential gains and the risks that come with investing in a rapidly evolving technology.

- Get Practical Investment Strategies—This section will provide practical strategies to gain exposure to quantum computing— including diversified ETFs, early-stage opportunities, and indirect investments, therefore; enabling technologies like AI, photonics, and semiconductors.

- Manage Risk in a Changing Tech Landscape—The final section will discuss how to manage your investment risk in this fast-moving industry. Notably, from valuation volatility to regulatory shifts, this will help to explore the challenges while staying positioned for future growth.

Why 2026 matters for quantum investing?

The years 2024 and 2025 marked a turning point for quantum computing investing. Funding surged as global investors backed those startups who are building the next-generation quantum systems. Moreover; these years also saw rapid progress in quantum commercialization. Companies launched pilot projects and new partnerships between research labs and major corporations. Nevertheless, industry analysts now agree that quantum technology revenues will accelerate through the late 2020s. The market is shifting fast — moving from pure R&D to early commercial deployments in finance, healthcare, and cybersecurity.

According to McKinsey, quantum technologies including computing, sensors, and communications could generate tens of billions of dollars in annual revenue by the 2030s. Most of this growth will come from quantum computing, which is quickly becoming the centerpiece of deep-tech investing.

- Quantum Investment Surges in the Mid-2020s—Quantum computing investing has been exploded in recent years. Both venture capital and public funding surged in the mid-2020s, as confidence in the technology grew. By 2024 and 2025, publicly announced quantum investment reached the hit high records. Additionally, dozens of startups raised millions in private funding rounds, and the industry witnessed a wave of mergers and acquisitions that signaled strong market consolidation. This boom confirms one thing — quantum computing has moved from theory to a full-scale investment theme.

- Quantum Market Growth Looks Promising—According to the Quantum Index Report (QIR) and multiple industry analyses, the market’s growth outlook remains exceptionally strong. Several market research firms, including MarketsandMarkets forecasted the sustained double-digit CAGR for the quantum computing sector throughout the 2020s. This means investors can expect a multi-year growth cycle, powered by new applications in AI, cryptography, and data optimization. All these are key drivers for long-term ROI.

- Quantum ETFs Make Investing Easier—Not ready to invest directly in startups? Then you can still participate in the quantum revolution through thematic ETFs. Funds like the Defiance Quantum ETF (QTUM) offer diversified exposure to companies working in quantum computing, machine learning, and advanced AI technologies. These ETFs are ideal for investors who want quantum exposure with lower risk, making them a smart entry point into this emerging trillion-dollar ecosystem.

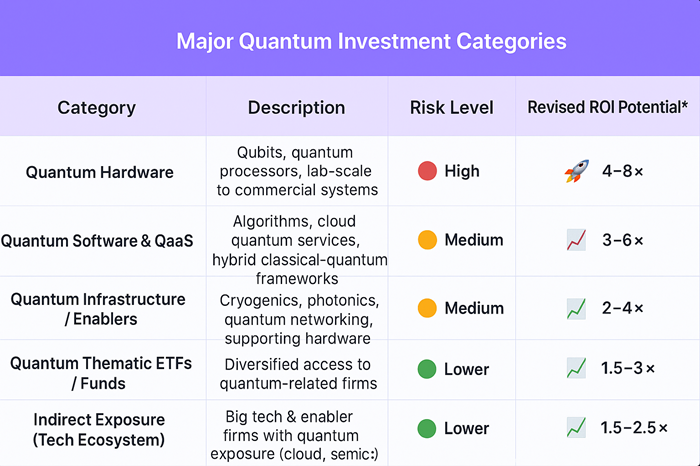

How investors can get exposure?

- Direct Public Equities —Pure quantum companies like IonQ, Rigetti, and D-Wave have become the face of quantum computing investing. These publicly traded pioneers represent the highest upside opportunities. On the other hand, they also carry higher volatility. For investors with a long-term view, the IonQ’s latest financial updates show strong revenue growth, driven by the increasing enterprise demand. However, like many emerging tech firms, they continue to invest heavily in R&D, reflecting a growth with loss phase, typically of early-stage disruptors. Key takeaway: Pure quantum stocks offer massive ROI potential, if adoption scales but they also require patience and risk tolerance.

- Enablers and Strategic Partners—Not all winners in the quantum computing boom will be hardware builders. Certainly, major cloud providers like AWS Braket, Microsoft Azure Quantum, and Google Cloud Quantum are creating infrastructure that supports quantum applications. Additionally, semiconductor suppliers like cryogenics experts, photonics companies, and quantum software developers are vital enablers. Moreover; these firms often deliver steadier, lower-risk returns, making them ideal for balanced portfolios.

- Thematic ETFs and Quantum Funds—For retail investors, quantum ETFs provide an easier entry point into this complex market. Notably, funds such as the Defiance Quantum ETF (QTUM) offer diversified exposure to companies innovating in quantum computing, machine learning, and AI infrastructure. Similarly, ETFs like QTUM reduce the single stock risk and allow investors to benefit from the broad quantum ecosystem, without the need of deep technical knowledge.

- Private Deals and Venture Capital—For accredited investors, private quantum deals are another high reward path. Startups, such as the QuEra raised major funding rounds in 2025, attracting institutional backing from global funds. Private investments in quantum hardware and software require patience, large minimums, and longer exit horizons, but the ROI potential remains strong as the technology matures.

- Indirect Exposure Through Tools and Services—Investing indirectly can also pay off. Companies offering quantum software platforms, simulators, hybrid algorithms or integration services are capturing growing demand from enterprises, thereby testing the quantum ready solutions. These indirect plays offer lower risk while still aligning with the broader growth of the quantum computing market.

What realistic ROI looks like (and why timelines are long)?

Investing in quantum computing technology offers an asymmetric upside — meaning the potential gains far outweigh the risks. Once a fault-tolerant quantum computer is capable of solving real-world problems, it could unlock massive value for early investors and intellectual property (IP) owners. However, the timeline for full commercialization remains uncertain. Progress is steady but gradual. The first wave is already visible through QaaS models and specialized niche applications in fields like cryptography, logistics, and drug discovery.

This means investors who enter early and stay patient could see the strongest long-term ROI as the technology matures.

- High-reward scenario (low probability)—Early breakthroughs in fault-tolerant quantum computing and advanced error correction are set to transform the industry. As these technologies mature, quantum adoption is expected to accelerate rapidly across pharma, materials science, and optimization sectors. This wave of commercialization could create the first generation of pure-play winners — companies positioned at the core of quantum innovation. For investors, these early movers may deliver massive multiples and long-term ROI as real-world applications expand.

- Moderate-reward scenario (higher probability)—The incremental commercialization of quantum computing is already reshaping the tech investment landscape. As discussed before, companies are already beginning to generate steady, recurring revenue streams by using models like QaaS and hybrid classical-quantum algorithms. Nevertheless, these developments are creating powerful opportunities for specialist quantum firms and large technology partners, especially in cloud computing and enterprise software. As adoption grows, investors who recognize these early revenue signals could tap into one of the most sustainable growth trends in tech for 2026 and beyond.

- Low-reward scenario— Tech startups face significant revenue growth challenges as technical bottlenecks and competition from advanced classical algorithms slow progress, forcing many emerging technology ventures to consolidate or fail.

Risk checklist — what to watch before you invest

Investing in quantum computing carries significant risks and opportunities. Scalability limits, qubit errors, and the quest for fault-tolerant designs continue to challenge startups and a failure in one approach can sink a company. Surprisingly, high capital intensity leads many firms to operate at a loss, despite of fast revenue growth. Similarly, competitive pressure is fierce with large cloud providers and well-funded startups are consolidating the key market segments. Certainly, strategic government funding and regulation can redefine winners geographically, highlighting the importance of staying informed.

The Smart Quantum Investing Playbook: Maximize Growth, Minimize Risk

- Learn by Doing—Dive into open-source quantum tools like Qiskit and Cirq. Hands-on experience reveals which problems quantum computing can actually solve, sharpening your investment instincts.

- Core-Satellite Strategy—Anchor your portfolio with stable ETFs and technology enabler stocks. Then, add a smaller satellite allocation to pure-play quantum startups or private funding rounds to capture high-growth potential.

- Dollar-Cost Average—Quantum investments are volatile. Invest gradually over time to smooth out risk and avoid chasing market swings.

- Track Milestones, Not Prices—Focus on technical breakthroughs like improved qubit error rates, simulation demos, or pharma/finance partnerships—and on revenue guidance updates—rather than daily stock fluctuations.

- Keep Exposure Measured—For retail investors, quantum should stay a small, single-digit portion of your portfolio. Increase only as your knowledge and confidence grow.

Quantum investing rewards patience, education, and strategy.

Stay informed, trust milestones over hype, and make every quantum investment decision a smart one.

Final Thoughts: How to Stay Ahead in Quantum Investing

Quantum computing investing in 2026 offers both excitement and uncertainty. As the science advances rapidly, investors should focus on understanding the fundamentals, tracking key breakthroughs, and using diversified ETFs or enabler stocks for balanced exposure.