Cryptocurrency is no longer a futuristic concept. Infact, it’s a global financial force rewriting the rules of money, trade, and digital ownership. As we move into 2026, investors, traders, and tech enthusiasts are all asking the same question:

What’s next for crypto?

The crypto landscape is changing faster than ever. Certainly, markets are experiencing explosive growth, and new regulatory battles are emerging. At the same time, AI-driven trading is on the rise alongside with government-issued digital currencies. Therefore, in this blog article, we’ll break down the most persuasive and high-impact cryptocurrency news predictions that could shape the future of digital finance and your investment choices.

1. Bitcoin’s Next Major Rally could Happen Sooner Than You Think

In fact, Bitcoin (BTC) is no longer just a digital currency—it’s a global investment powerhouse, poised for its next historic surge. Despite short-term price volatility, top cryptocurrency analysts predict BTC could hit new all-time highs, as global demand for crypto continues to soar. Moreover, institutional investors are steadily increasing their BTC holdings, while leading companies are now adopting BTC as a reserve asset. All these signs point to the next Bitcoin bull run, arriving sooner than many expect.

Why Bitcoin Matters for Investors in 2026:

-

In general, BTC remains the top choice for long-term crypto investing and wealth preservation.

-

Indeed, its price movements often set tone for the entire cryptocurrency market.

-

Consequently, scarcity caused by Bitcoin halving cycles continues to drive long-term value upward.

Expert Prediction: By early 2026, BTC could experience a strong upward trend as more financial institutions enter the market, creating lucrative opportunities for early adopters and crypto enthusiasts.

2. Governments are Racing to Launch Digital Currencies

One of the most significant cryptocurrency trends in 2025/26 is the rapid rise of Central Bank Digital Currencies (CBDCs). For example, countries like China, India, and members of the EU are already testing or rolling out digital fiat currencies. Moreover, this could fundamentally reshape global payments, banking, and the adoption of digital money.

Why CBDCs Matter:

-

Enable faster, cheaper, and more secure transactions compared to traditional banking.

-

Accelerate mainstream adoption of digital currencies. Obviously, bridging the gap between conventional finance and the crypto world.

-

Also, create a pathway for seamless integration between centralized banking systems and decentralized finance (DeFi) platforms.

Smart investors and crypto fans who follow this trend can actively profit from the future of digital finance. For instance, global markets face rising inflation, tightening regulations, and growing demand for faster cross-border payments. As a result, governments are accelerating their shift toward digital financial infrastructure.

Expert Prediction: By 2026, at least 10 major economies will launch or expand their CBDC pilot programs, driving rapid growth in digital currency adoption. Moreover, this move signals one of the biggest transformations in the global financial system, reshaping everything from banking to international trade. For example, investors and crypto enthusiasts who tap into the momentum of Central Bank Digital Currencies, digital payments, and blockchain-based finance can capitalize on the next major wave of digital finance innovation.

3. AI and Blockchain Integration is Redefining the Future of Crypto Trading

The rapid convergence of Artificial Intelligence (AI) and blockchain technology is emerging as one of the most disruptive forces in the cryptocurrency market. Today’s AI-driven crypto trading bots are becoming more accurate, more adaptive, and more accessible to everyday traders—offering insights and automation once available only to professional trading firms. Notably, machine learning, real-time blockchain data, and automated trading algorithms are empowering crypto investors to analyze trends and execute trades more effectively.

Here’s what this AI–crypto revolution means for traders:

-

Ultra-precise AI market predictions fueled by machine learning models

-

Fully automated risk management systems that protect portfolios 24/7

-

Real-time pattern recognition across volatile crypto markets

-

Tailored and personalized trading strategies, optimized for profit

Ultimately, AI is no longer a secondary tool—it’s becoming the core engine of modern crypto investing, enabling traders to respond faster to market volatility, reduce emotional decision-making, and unlock data-driven opportunities.

Prediction: By 2026, more than 60% of active crypto traders may adopt AI-powered trading tools, marking one of the largest shifts toward automation and intelligent investing in the blockchain ecosystem.

4. Stronger Crypto Regulations are Coming—And They May Accelerate Global Adoption

The global push toward stronger cryptocurrency regulations is gaining momentum. Contrary to common fears, this new regulatory wave could become one of the biggest catalysts for long-term crypto growth. As digital asset adoption rises, governments and financial authorities are rolling out clearer and more consistent crypto regulations to protect investors and boost market stability. These updates could finally give the industry the clarity it needs to attract large-scale institutional capital.

Major regulatory changes expected across global crypto markets:

-

Clearly defined legal frameworks for stablecoins and digital assets

-

Unified crypto taxation rules to simplify the reporting for investors

-

Enhanced exchange transparency requirements to reduce fraud

-

More robust AML and KYC policies to strengthen consumer protection

Instead of holding back innovation, these regulations are poised to boost trust, enhance compliance, and drive mass adoption across both the retail and institutional investors. With greater transparency and standardized rules, the crypto industry becomes safer, more credible, and more appealing to traditional financial players.

Prediction: Expect major crypto regulatory announcements from the U.S., European Union, and key Asian markets in 2026, reshaping future of the cryptocurrency industry. Consequently, it will create a more secure, structured, and investor-friendly global crypto ecosystem.

5. DeFi Is Entering a New Era of Growth—Stronger, Safer, and Ready for Mass Adoption

Decentralized Finance (DeFi) continues to dominate as one of the fastest-expanding sectors in the crypto industry. But for years, security breaches, protocol exploits, and rug pulls have slowed its path to mainstream acceptance. As a result, the landscape is shifting. A new generation of high-security DeFi platforms is emerging—designed to protect users, eliminate vulnerabilities, and bring institutional-grade reliability to decentralized finance.

Breakthrough improvements driving the next wave of DeFi adoption:

-

Comprehensive smart-contract audits to prevent hacks and code exploits

-

Insurance-backed DeFi protection offering greater financial security

-

Advanced decentralized identity (DID) verification to reduce fraud and strengthen trust

Indeed these new security advancements, DeFi is becoming a safer and more transparent financial system. It now allows anyone to access decentralized lending, staking, yield farming, and automated trading without needing banks or middlemen. As DeFi becomes more secure and trustworthy, more people are confidently joining the ecosystem, driving even faster adoption.

Prediction:DeFi’s Total Value Locked (TVL) framework is expected to hit new all-time highs as safer, fully audited, and insurance-backed DeFi platforms. Notably, these stronger security measures are attracting mainstream investors, institutional capital, and global crypto users who want high-yield and bankless financial opportunities. As trust increases, more money flows into DeFi—fueling explosive growth across the entire ecosystem.

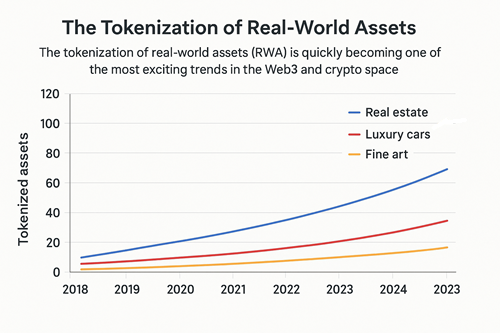

6. Web3 and Real-World Assets (RWA) are About to Take Off in a Massive Way

The tokenization of real-world assets (RWA) is quickly becoming one of the most exciting trends in the Web3 and crypto space. This powerful innovation makes it possible to own fractional shares of real estate, luxury cars, fine art, and other high-value asset directly on the blockchain. By converting physical assets into digital tokens, Web3 is opening the door to a completely new era of global investing.

Why investors are paying attention:

-

Lower entry barriers make premium assets accessible to everyone

-

Higher liquidity allows investors to buy and sell asset tokens instantly

-

Transparent blockchain transactions reduce fraud and increase trust

-

Global accessibility enables anyone from anywhere to participate

Major tech companies, financial institutions, and blockchain platforms are already exploring tokenized real estate, tokenized commodities, and tokenized investment products, proving the massive potential of RWAs.

Prediction: RWAs are expected to become one of the top-performing crypto categories in 2025–2026, as tokenization transforms traditional finance and brings trillions of dollars of real-world value into the blockchain.

7. The Metaverse isn’t Dead—It’s Evolving into its Next Big Chapter

The metaverse may have lost some of its early hype, but its innovation and potential are stronger than ever. Leading tech companies and blockchain developers are investing billions in AR (augmented reality), VR (virtual reality), immersive digital worlds, and next-generation metaverse experiences. Far from a fading trend, the metaverse is transforming from a buzzword into a platform with real-world utility, and crypto is driving this resurgence.

Why Crypto-Powered Metaverse Projects are Poised for a Comeback:

-

Next-generation AR/VR technology delivering ultra-immersive virtual experiences

-

Virtual land, digital concerts and in-world economies offering tangible utility

-

High-profile partnerships with top gaming studios and entertainment brands

-

Seamless integration with NFTs, blockchain-based ownership and digital collectibles

This evolution positions the metaverse as a central pillar of Web3: the future of online interaction, digital identity, and gaming ecosystems.

Prediction: By 2026, at least two major crypto-metaverse projects are expected to make a powerful comeback, dominating crypto news and rekindling interest in virtual worlds and digital ownership.

Final Thoughts: The Future of Crypto is Closer Than You Think

The cryptocurrency market is evolving faster than any financial system in history. With government-backed digital currencies (CBDCs), AI-powered crypto trading, and the tokenization of real-world assets, the next era of crypto innovation is already unfolding.

To stay ahead in the rapidly growing crypto industry, it’s crucial to:

- Monitor crypto regulations and government policies

- Track bitcoin, ethereum, and institutional adoption trends

- Explore promising DeFi, AI-driven crypto projects, and blockchain startups

- Follow the latest crypto news and market developments daily

In short, cryptocurrency is no longer a niche market. It’s reshaping global finance, driving digital asset adoption, and setting the stage for the future of money.